Background

It is essential for brands to find unique ways to gain competitive advantage by differentiating themselves from their competitors. The Zion & Zion market research team is engaged in an exclusive in-depth series of studies to understand how consumers perceive the personalities of top U.S. brands. This article is the first in our new series on 45 major brands in 15 industries (see tables 1 and 2). In this series, we analyze how top brands are perceived across three key brand personality scales: Aaker’s (1997) classic five dimensions of brand personality; Freling, Crosno, and Henard’s (2011) brand personality appeal dimensions; and Haji’s (2014) negative brand personality dimensions. In this first article of our series, we investigate the classic five dimensions of brand personality by Jennifer Aaker. In future articles, we will explore the other dimensions of brand personality, highlight the impact various brand personality dimensions have on brand performance, perform deep-dives into the 15 industries and more.

Table 1. Industries Included in this Study

Table 2. Brands Included in this Study

Executive Summary

The Zion & Zion research team sought to gain a deep understanding of the brand personalities of 45 top brands in the U.S. The brands were selected based on established brand value and industry leadership rankings. We surveyed 9,309 adults, 18 years of age and up. Each respondent was asked about one of the brands. Respondents in our survey were also asked to rate their familiarity with each brand on a scale of 1 to 7, with 1 being “very unfamiliar” and 7 being “very familiar.” Only respondents who answered with at least “somewhat familiar” (5 or higher) were retained for the study which resulted in a data set of 6,444 responses.

In this article, we introduce the industries and brands in our study, shed light on the different facets of brand personality in the Aaker scale, and provide a high-level overview of results for that classic scale. We show that major brands are characterized by a range of brand personalities.

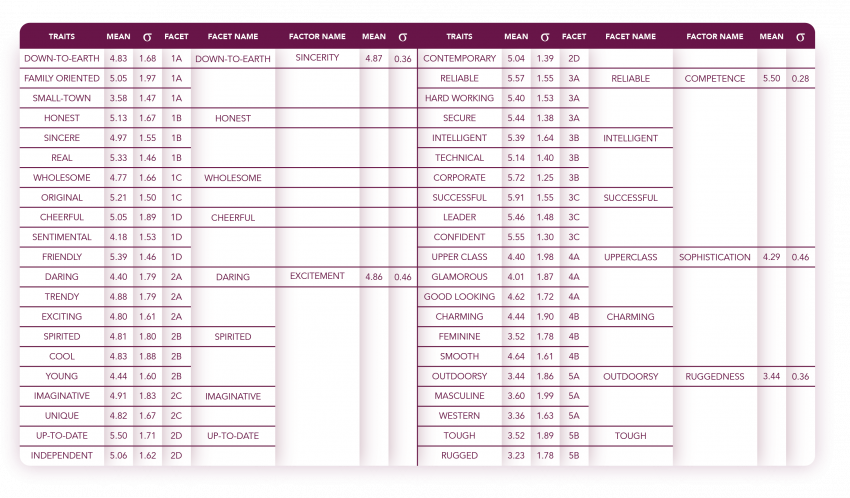

Aaker’s classic brand personality scale

Understanding the personality of any brand requires a multi-faceted approach. Our large database describes the brand personality (BP) of each of the top 45 brands using the well-established scale by Jennifer Aaker (1997). This scale consists of 5 brand personality dimensions: Sincerity, Excitement, Competence, Sophistication, and Ruggedness. Each of these dimensions consist of multiple facets, and each facet consists of multiple traits. A total of 42 traits describes each brand’s perceived personality (see table 3 for a summary of the average score for all 45 brands on all traits and dimensions).

Table 3. Scores for the Average of all 45 Brands on all Traits

Factors

Aaker asserts that, “personality traits associated with a brand, such as those associated with an individual, tend to be relatively enduring and distinct.” (Page 347) In her article, she encourages firms that are searching for new ways to distinguish themselves and gain a lasting competitive advantage with strong brand loyalty to look at differentiation by establishing a desirable brand personality.

The Zion & Zion research team asked each respondent to assess how well each trait describes one of the 45 brands. The traits were presented on a scale of 1 to 7, with 1 being “not descriptive at all” and 7 being “extremely descriptive.” Each question in the survey was displayed randomly to each respondent to help avoid ordering effects or respondent fatigue. The personalities were calculated by first averaging each trait associated with a facet and then averaging each facet associated with the broader personality dimension.

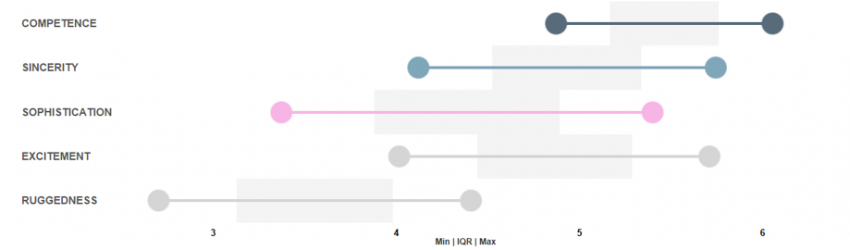

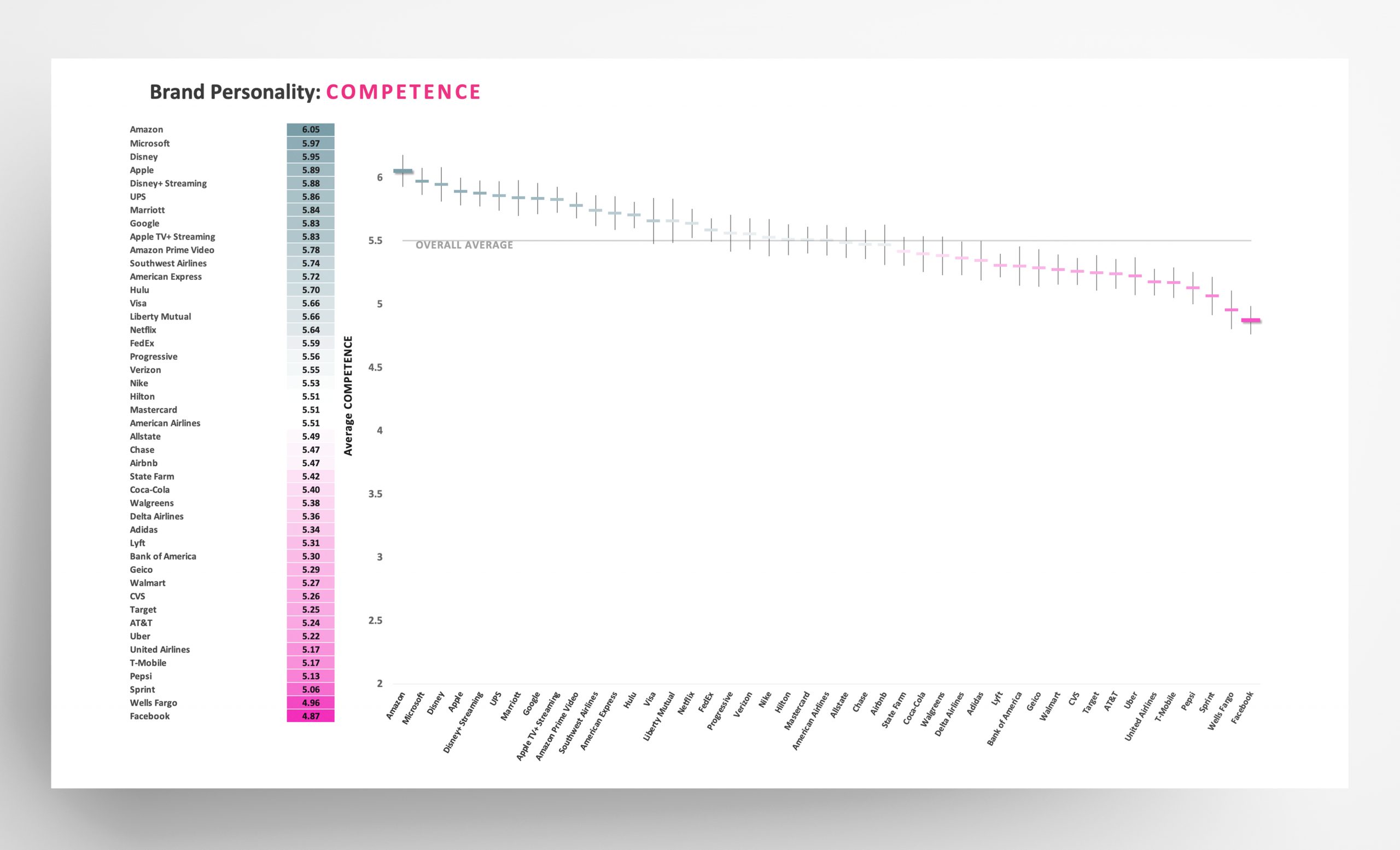

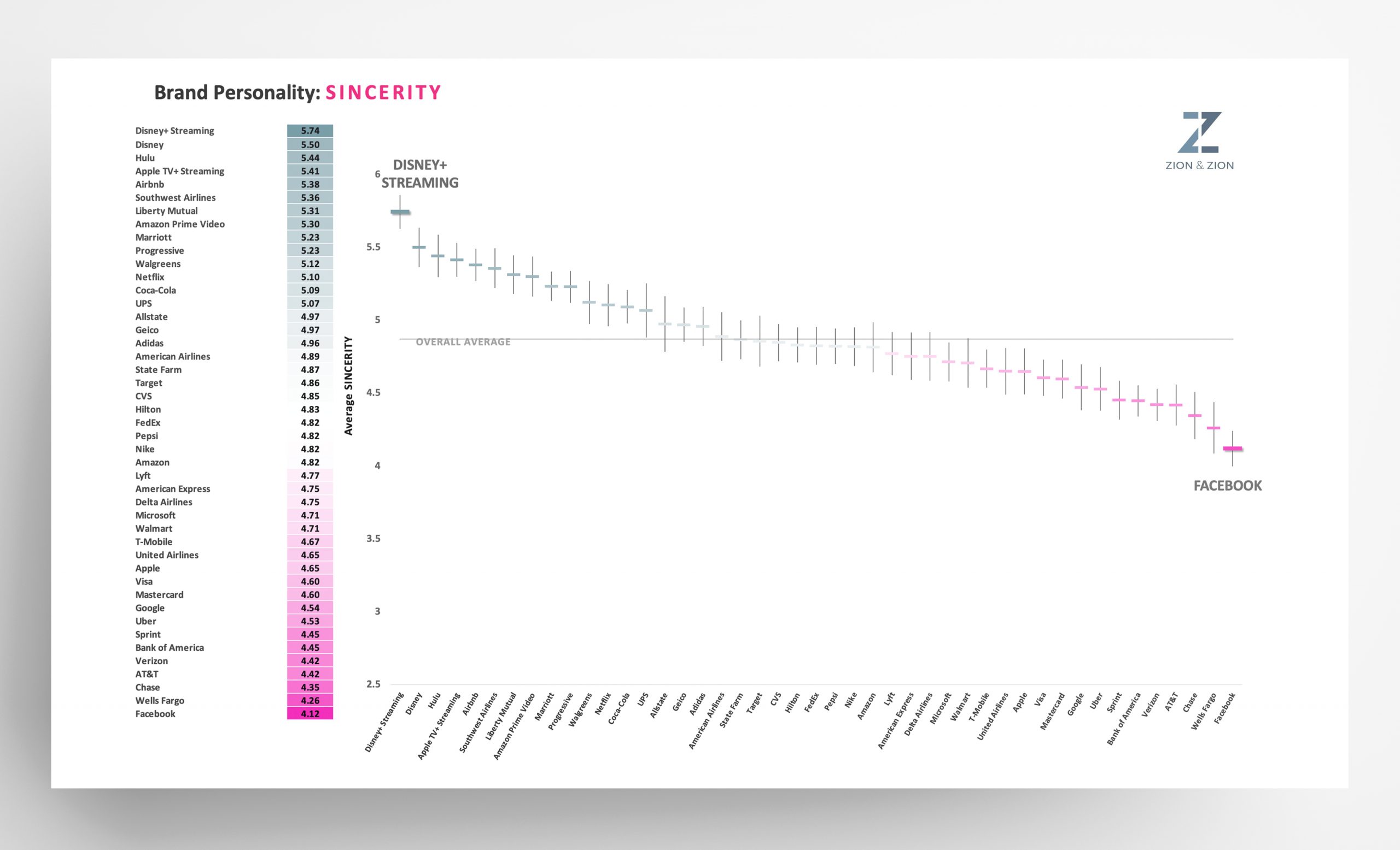

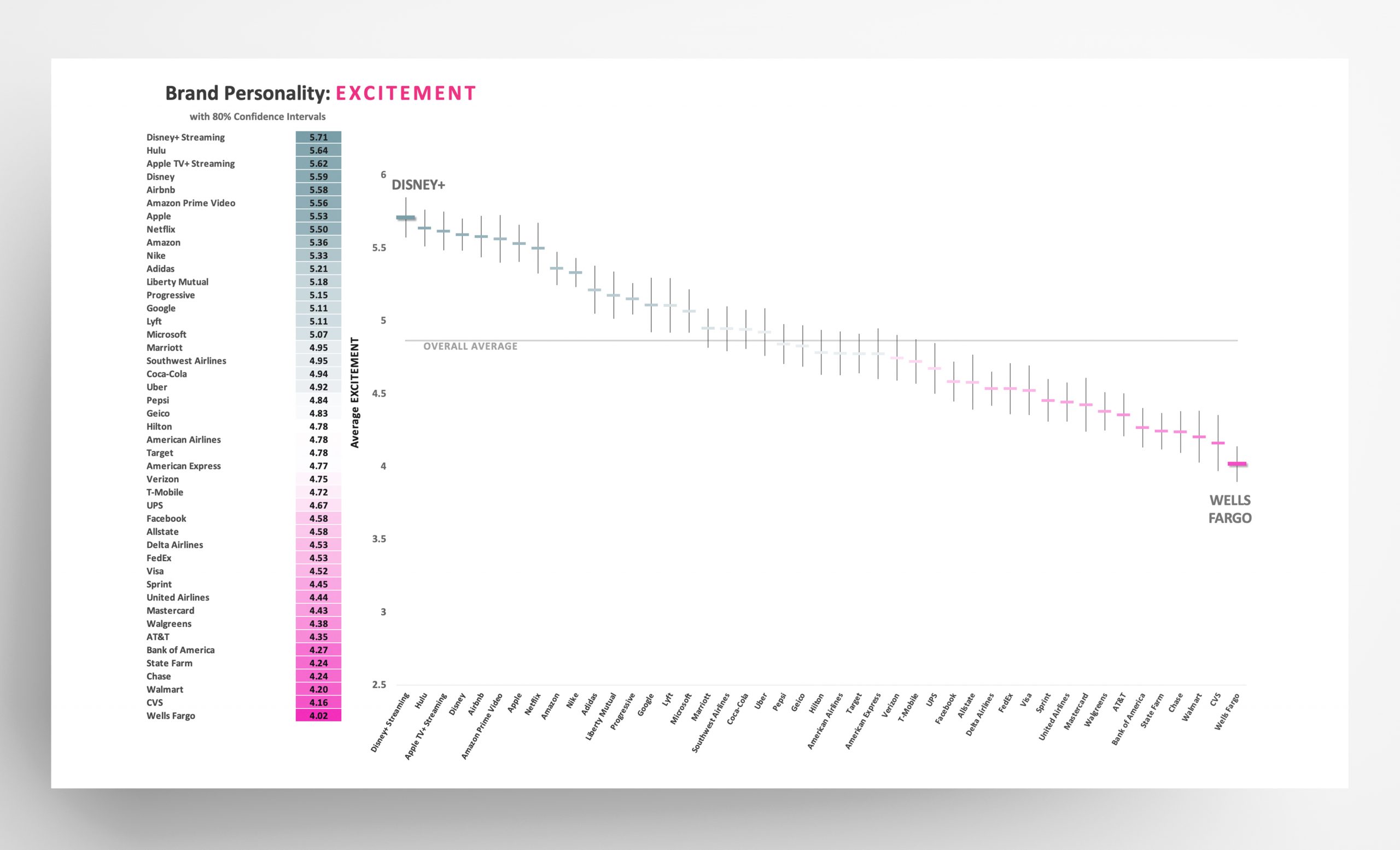

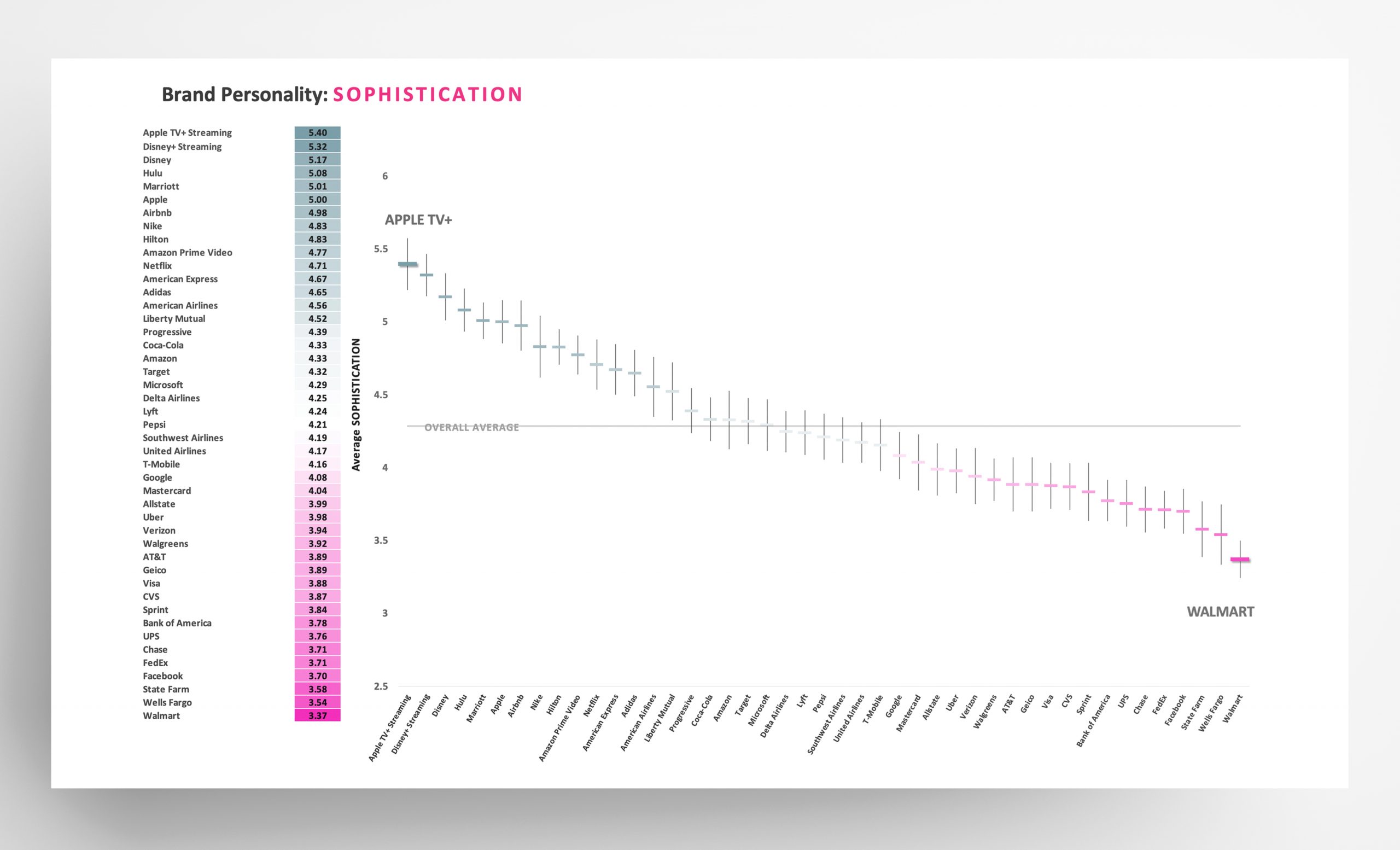

When comparing Aaker’s 5 brand personality dimensions to each other (Chart 1), we find that the top brands score highest on competence, followed by sincerity, excitement, and sophistication, while scoring lowest on ruggedness. Our interpretation of this finding is that it takes establishing a brand as competent in its industry for a company to develop one of the leading brands.

Chart 1. Middle scores and Ranges across all 45 brands

Our 45 brand personalities

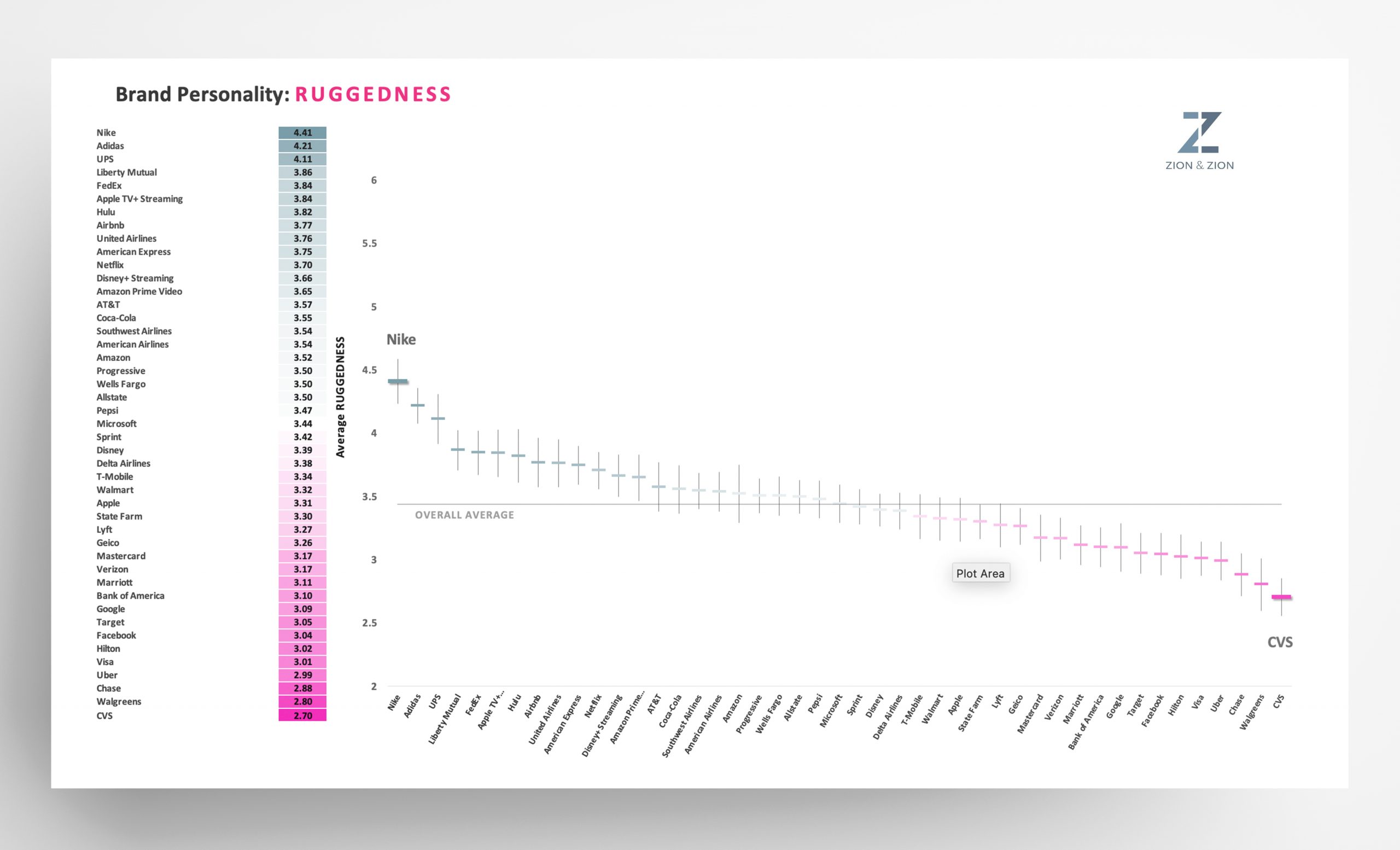

The following charts (charts 2-6) show the personalities of the 45 major brands in our study. For each of the five dimensions, we use one chart to display the average score of each brand’s personality in comparison with the personalities of all other brands. In the charts, each brand is represented by a line reflecting the score that the brand is rated at for each of the dimensions by consumers. We also display the 80% confidence interval of that perception, allowing for an estimate of statistical difference comparisons across brands.

We can see that, as a group, the 45 brands have varying scores across the five dimensions, i.e., no brand scored high on all dimensions or low on all dimensions. The Disney+ Streaming Service has the highest score on 2 dimensions (sincerity and excitement), Amazon leads on competence, Apple’s TV+ leads on sophistication, and Nike leads on ruggedness. Facebook has the lowest score on two dimensions (competence and sincerity), Wells Fargo has the lowest excitement scores, Walmart is lowest on sophistication, and CVS is lowest on ruggedness. For each brand, we can track its personality scores across all 5 dimensions. For example, compared to the other top brands, Marriott hotels are perceived as middling on excitement, medium-high on sincerity, high on competence, high on sophistication, and medium-low on ruggedness. We will provide a more detailed analysis of each brand in later instalments of our series.

Chart 2. Competence Average for all 45 brands

Chart 3. Sincerity Average for all 45 brands

Chart 4. Excitement Average for all 45 brands

Chart 5. Sophistication Average for all 45 brands

Chart 6. Ruggedness Average for all 45 brands

Interpreting the data

When interpreting the data shown on the charts, it is important to keep in mind that each brand has its own unique profile that needs to be understood in relation to the brand’s positioning and target segment. It would be misleading to see this as a competition where a brand is strong if it scores high on all facets. The same is true for evaluating a brand as a “loser” on any specific dimension by looking for the brand with the lowest score. The data is only a portrait of consumer perceptions—i.e., “what is” as opposed to “what is best.”

For example, the Disney+ Streaming Service leads the pack in Sophistication and Wells Fargo trails the pack on that dimension. However, Disney+ may indeed wish consumers to perceive it as relatively sophisticated while Wells Fargo may not—although we suspect that Wells Fargo would not wish to be in last place on this dimension.

There may also be trade-offs for some brands’ image, when for example ruggedness matches well with this brand’s preferred consumer segment but might connote negative images for the average consumer.

Putting the data to work

This article is the introduction for a multi-part series, where we will look at each of the brands in 15 industries in more detail. In this series, we will look at how each brand’s profile matches up with its competitors, what facets are key for market success in each industry, and we will also evaluate a series of industry-specific questions.

The Zion & Zion research team encourages marketers to look at how they want their brand to be viewed by consumers and look for ways to distinguish themselves from the pack. In our series we will show that by choosing specific areas to improve, brands can distinguish themselves from the pack. Our series can thereby show how such differentiation can help brands to gain a competitive advantage.